Every year, typically by the last week of February you will be mailed your new notice of assessment informing you of your updated State Equalized Value and Taxable Value on your property. This notice is sent to all property owners in Michigan.

Understanding Terminology

State Equalized Value (SEV): The dollar value of an asset assigned by a public tax assessor for the purposes of taxation.

SEV x 2 = The Township Assessors total estimated current market value for your home and/or property.

Taxable Value: The current dollar value assessment established for property tax purposes.

Taxable Value x 2 = The total estimated dollar value for your home and/or property that you will be paying tax on.

Taxable Value x Your Township Millage Rate + Township Administration Fee (1% fee charged in some townships)= Your Tax Bill

-In 1994 Michigan passed Proposal A creating a new standard in which your property tax would be calculated. The current tax law allows the taxable value of a property to increase by the lesser of 5% or the rate of inflation. In recent years inflation has been under 5% so your tax bill would increase yearly by that rate. Property values, until recently, had continued to soar and appreciate above the rate of inflation. This created a gap between your State Equalized Value (which has no limit to its increase ceiling per year) and your Taxable Value (which had a max of 5% per year value increase).

Why is my tax bill still increasing during this downturn?

-Today, most home and property values in Leelanau and Grand Traverse Counties have flattened or declined so you should not see your SEV continue to soar at high percentages from year to year like in the past. There still might be a gap between your SEV and Taxable Value (As the local real estate market declines these numbers will become closer in value). This is why you will see your tax bill continue to increase every year (by the rate of inflation or 5%, whichever is less) until your Taxable Value = Your State Equalized Value. If your current taxable value is less than your current SEV Proposal A has saved you money! However the taxable value may need to be adjusted to meet current market values. The current law allows upon sale of a property the taxable value of a property to uncap to the current level of the properties SEV. This is why the year after the purchase of a property a new owner must be sure to pay particular attention to this notice!!

How do I reduce my property taxes?

1) Upon receipt of your notice of property assessment from your local Township Assessor in February of each year you should review your properties proposed SEV and Taxable Values. (This notice will be labeled Notice of Assessment- THIS IS NOT A TAX BILL)

2) By multiplying this proposed current year Taxable Value x 2 you will be able to determine the dollar value of the property the local assessor will be basing your current year’s taxes. If your house is worth more than this value then you have no case to reduce your taxes for this year. Conversely, if you feel the proposed Taxable Value of your property X 2 is more than you feel your house is worth you could have a case.

3) By multiplying the proposed current year SEV by 2 you will be able to determine the current dollar (market) value the local assessor has placed on your property.

4) Be sure to check your Homeowners Principal Residence % exemption to be sure it is correct. 100% means you are receiving this exception as your primary home for this calendar year.

5) Every township and/or city has specific times published on this notice and in the local paper (Leelanau Enterprise and Record-Eagle) during early March which is the designated time for you to meet with the township assessor and a local board of review for reviewing your case. At this time you must come prepared with sales data and/or official appraisals of recent sold comparables to your property. These published times in early March are your only opportunity all year to plead your case to reduce your entire years tax bill. If you miss this “Board of Review” you must wait until March of the following year. There are a few exceptions to this rule. The Township Assessor could agree to correct errors on the properties tax card during the year within a specific time frame required by the state.

Official written appraisals by a state licensed appraiser are your best option for obtaining statistical data confirming your properties over assessment. This written appraisal will have a cost associated to its completion with no guarantee that the local board of review will reduce your tax assessment and your bill! If your property is greatly over assessed this cost will be minimal in relation to the savings you may receive if you are successful in obtaining a reduction in your properties tax assessment.

6) Determining your proposed estimated yearly Tax Bill from this notice: By multiplying this Taxable Value times your individual townships mileage (with correct school district) and taking into consideration this properties homestead exemption status you will be able to determine the estimate of your updated tax bill. This amount may vary slightly by townships across Michigan because some townships charge a 1% administration fee for each tax bill.

If there are further questions regarding this issue we suggest you contact your local Township Assessor.

As experienced Realtor professionals at Oltersdorf Realty we do our best to assist our former clients in making sure they are being properly assessed well after we assisted them in purchasing their property or home. This notice is intended to alert all property owners that these notices are very important and must not be ignored despite the statement at the top of the document saying THIS IS NOT A TAX BILL!!!!

Written by:

Vicky Oltersdorf & Jonathan Oltersdorf

Oltersdorf Realty, LLC

231-271-7777

/

RealEstate@Oltersdorf.com

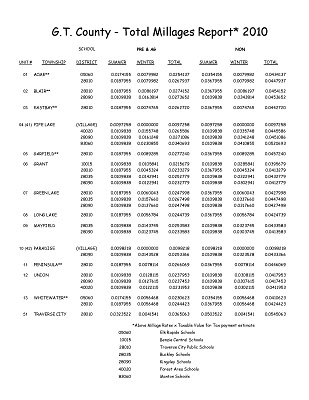

GRAND TRAVERSE COUNTY MILLAGE RATES

(Click HERE to Download)

©This article is copyright protected 2010, protected by Oltersdorf Realty, LLC. ALL RIGHTS RESERVED. Any use of materials on this Web site, including reproduction, modification, distribution or republication, without the prior written consent of Oltersdorf Realty, LLC, is strictly prohibited.